Diverse categories and formats in today's retail landscape involve managing numerous SKUs with pricing often governed by uniform rules and markups for each product category, dictated by its role and strategy. However, the competitive nature of the market necessitates applying competitive pricing strategies to individual SKU baskets.

Balancing the intense competition in front-baskets and Key Value Items (KVIs) while effectively pricing the remaining back-basket to retain or increase gross yield is a critical challenge in retail pricing. This challenge is further compounded by the need to localize prices at the level of individual store clusters.

Addressing this complex issue requires a differentiated approach to pricing at the individual SKU tier, considering the localization of price matrices at the store clusters tier. By analyzing sales and buyer responses to changes in individual SKU prices within the same category, it becomes evident that different SKUs exhibit varying price elasticity, fall within different price ranges and segments, and possess distinct potentials for increasing gross yield.

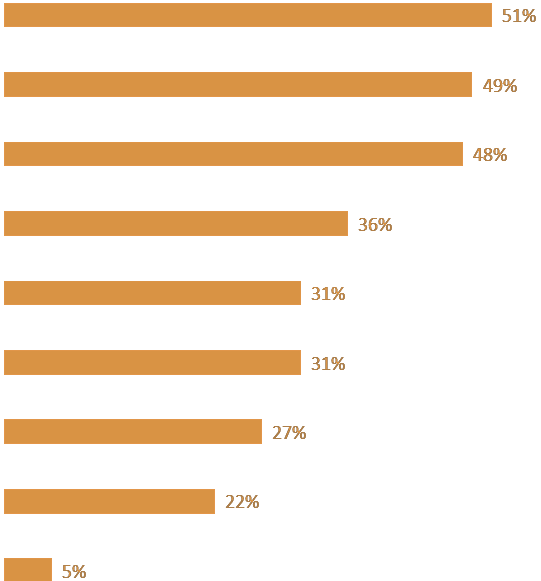

In a given category, for example, price sensitivity can vary by more than 50%, ranging from -1.5 to -2.3, and profitability can differ by over 25%.

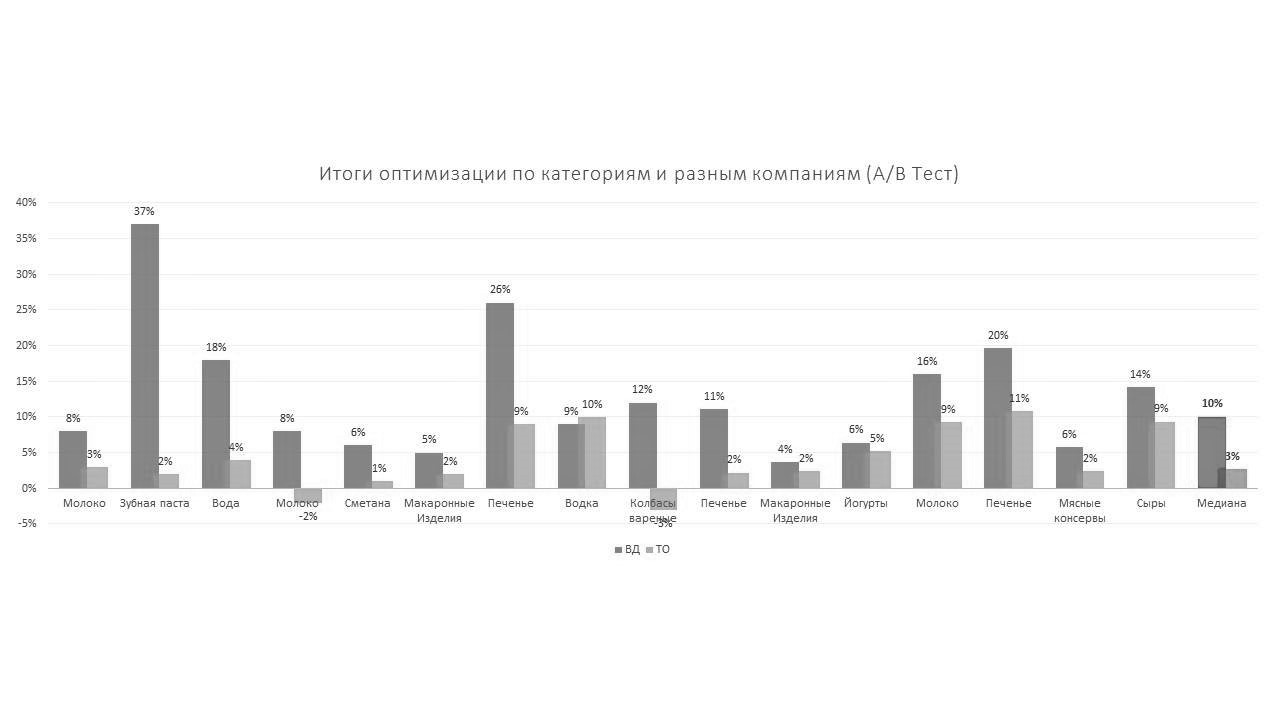

Manual differentiation of numerous SKUs in many chains, often exceeding 400 categories, proves challenging. This challenge leads to emergence of so called "forgotten categories." Remarkably, addressing these overlooked categories has shown substantial success, with a 37% increase in gross yield achieved for one retailer in a previously neglected category, such as Toothpaste.

How to "squeeze" the maximum income from all possible positions and retain sales results?

With SmartPricing, you gain powerful tools to effectively address and optimize your pricing strategy:

With SmartPricing, you will retain control over every aspect of the solution, set rigid restrictions for parameters such as price increases, sales decreases, minimum profitability for individual SKUs, entire categories, and specific baskets. This control level will ensures a customized and well-managed pricing strategy tailored to your business objectives.

Competition in retail is growing fast, especially because of big federal companies with pricing advantages. Key challenges include price transparency, consumer awareness and aggressive pricing from rivals. This pushes retailers to differentiate their products, like introducing private labels and exclusive trademarks. But for other well-known brands, staying competitive means competing on price, even against federal players. This often leads to selling goods below cost to maintain pricing perception.

Price transparency impacted by:

The SmartPricing dynamic pricing solution offers robust features to address pricing differentiation and competition:

Creating distinct price matrices for diverse regions and formats is a fundamental pricing task, considering the varying value propositions associated with different formats. Presently, Category Managers and Pricing Departments must navigate down to the granularity of individual store groups and clusters. Even in a single city, stores of the same format may be situated in different locations, each with unique customer income levels and competitive landscapes.

Balancing gross yield preservation in less competitive environments and adjusting prices to maintain relative positioning in highly competitive areas adds complexity. While the concept seems straightforward, the multiplication of clusters by SKUs in the range matrix exponentially increases the complexity of resolving this challenge.

In a recent SmartPricing implementation project, a client established over 30 store clusters, each with an average active range matrix of 15,000 SKUs, resulting in a pricing task encompassing 450,000 price units.

SmartPricing, a data-driven dynamic pricing solution, was initially developed with retail company structures in mind. It effectively supports three primary pricing tiers: format, geographic area (locality), and store cluster.

This process involves structuring sales statistics to localize price sensitivity ratio calculations and minimize errors. During reevaluation, parameters and restrictions can be set according to the hierarchical tiers. Default format-level settings apply universally for all regions and clusters. Alternatively, specific parameters can be tailored for a chosen region and cluster, facilitating the computation of a localized price matrix for that specific store cluster.

REQUEST AN ISSUE RESOLUTION DEMONSTRATIONAccording to Nielsen's research, promotions contribute over 60% sales in top 20 FMCG categories, and in specific sectors like Coffee or Washing Powders, this figure can go up to 80%. Despite the increased significance, making accurate pricing decisions during promotions is even more crucial than regular product pricing. This raises the question: Why do chains implement promotions?

SmartPricing, a data-driven dynamic pricing solution, was developed with focus on retail company structure. It efficiently supports three primary pricing tiers: format, geographic area (locality), and store cluster.

From summarizing promotions discussion, two primary incentives emerge:

In the realm of decision-making, while the first case appears straightforward, the second scenario poses numerous questions. However, the crux of both lies in the decision-making process.

Nielsen's research reveals that approximately 60% of promotional endeavors fail to yield positive returns. This is largely attributed to chains' reliance on intuitive decision-making rather than leveraging available data.

Chains possess valuable data sources including receipt data, customer information from loyalty cards, and historical promotion data. By harnessing these data streams alongside modern computing resources, promotions can be propelled to new heights. Moving away from intuitive decision-making towards a data-driven approach can potentially yield over 10% in additional gross yield from promotional improvements.

Today, promotion planning and forecasting primarily constitute a mathematical problem, accounting for about 90% of the process. Traditional analytical tools fall short due to the multitude of factors and vast datasets involved. Moreover, the limited time resources of Category Managers necessitate a shift towards more prompt, transactional, and operationally oriented solutions. Weekly promotions leave little time for in-depth analytics, demanding solutions that prioritize agility and efficiency.

The "Promotion" module within SmartPricing offers a solution enabling retailers to address three primary questions based on their data:

With SmartPricing, you can effectively address various aspects of pricing and promotion management, offering solutions to the following issues:

In our pursuit to improved pricing efficiency, we're introducing a dynamic approach with diverse Know Value Item (KVI) baskets and an automated system for intelligent indicator goods selection.

Historically, our strategy involved product range segmentation through price baskets, including the Front Basket (FPG) for first price goods, KVI for indicator goods, and the Back Basket for the remaining range. This segmentation aimed to establish a price image (Front Basket) and optimize margins (Back Basket). Key competitors were carefully chosen and monitored, influencing subsequent price adjustments. However, this method led to a growing list of KVIs, resulting in price decreases and a subsequent decline in overall range matrix profitability.

Recognizing the evolving landscape, we've identified two primary challenges. Firstly, the need for more frequent KVI revisions has become apparent. Secondly, KVIs must now consider variables such as sales channel, location, and sales point format. The selection of key competitors is no longer a broad approach for the entire chain but is tailored to specific product categories. These adjustments are essential as market dynamics transform with the proliferation of specialty stores, demanding companies to compete on multiple fronts.

Introducing SmartPricing, featuring dedicated KVI Basket Management and competitive pricing functions, to elevate the flexibility and efficiency of your KVI-based competitive pricing strategy. With SmartPricing, you can:

Pricing transcends mere rule-based calculations in modern retail company. Upon analyzing typical processes and tasks within retail, distinct yet interconnected groups emerge. These processes, while interrelated, exhibit unique characteristics. Every retail company engages in building and implementing the following pricing business processes:

The SmartPricing data-driven dynamic pricing solution offers comprehensive support for managing the complexity and dynamics of pricing processes, facilitating scalability and localization within your retail chain by:

We specialize on tailoring individual solutions for each company, emphasizing and fortifying your unique competitive advantage and corporate «DNA». We achieve this by seamlessly integrating leading business practices, concepts, and technologies. Our expertise encompasses a range of key areas: